Blockchain technology has evolved far beyond its origins as the backbone of cryptocurrencies. It now powers innovations across industries like finance, healthcare, logistics, real estate, and entertainment. As we enter 2025, blockchain is poised to deliver groundbreaking opportunities for investors seeking to capitalize on its widespread adoption.

This guide will explore how to invest in blockchain technology strategically, offer insights into emerging trends, and explain how Certuity’s family office services can help you make informed decisions to maximize your returns.

Why Invest in Blockchain Technology?

Blockchain is more than just a buzzword; it’s a transformative force.

- Global Market Growth: The global blockchain market is projected to grow from $11.1 billion in 2022 to over $162 billion by 2027 (CAGR of 67.6%).

- Diverse Applications: From smart contracts and decentralized finance (DeFi) to non-fungible tokens (NFTs) and supply chain transparency, blockchain’s use cases are expanding rapidly.

- Institutional Adoption: Companies like Microsoft, IBM, and JPMorgan Chase are leveraging blockchain for security, efficiency, and transparency, signaling long-term value.

- Financial Inclusion: Blockchain simplifies access to financial services for unbanked populations, creating new markets and economic opportunities.

Ways to Invest in Blockchain Technology

1. Cryptocurrency Investments

Cryptocurrencies remain the most accessible blockchain-related investment. Popular options include:

- Bitcoin (BTC): The pioneer cryptocurrency, often referred to as “digital gold.”

- Ethereum (ETH): Supports smart contracts and decentralized applications (DApps).

Altcoins: Specialized tokens like Solana, Cardano, and Polkadot.

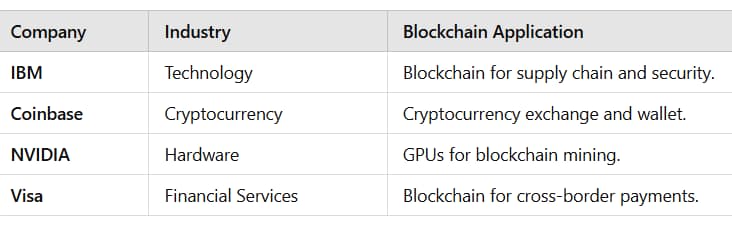

2. Blockchain Stocks

Investing in companies that develop or utilize blockchain technology offers a more traditional route.

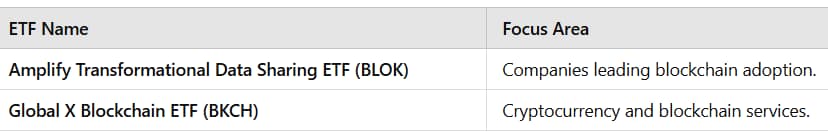

3. Blockchain ETFs

Exchange-Traded Funds (ETFs) offer diversified exposure to blockchain without the need for direct investment in individual stocks or cryptocurrencies.

4. Startups and Venture Capital

Investing in blockchain startups can yield high returns if you identify emerging leaders. Key areas to watch include:

- DeFi platforms.

- NFT marketplaces.

- Blockchain for healthcare and identity verification.

5. Real Estate on Blockchain

The tokenization of real estate allows fractional ownership of properties, enabling investors to enter markets with smaller capital.

Blockchain Trends for 2025

- Decentralized Finance (DeFi): DeFi is transforming traditional banking by offering decentralized lending, borrowing, and trading.

- Central Bank Digital Currencies (CBDCs): Governments worldwide are launching digital currencies, legitimizing blockchain on a global scale.

- NFT Evolution: NFTs are evolving beyond digital art into real-world applications like ticketing, gaming, and intellectual property.

- Green Blockchain: Eco-friendly blockchain networks like Cardano and Algorand will gain prominence as sustainability becomes a focus.

- Interoperability: Platforms enabling seamless communication between blockchains will drive innovation.

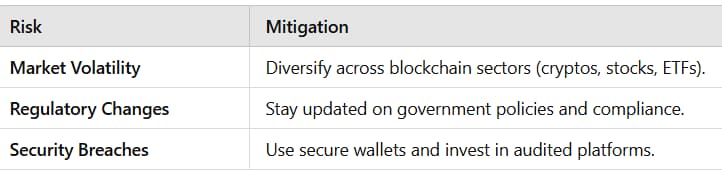

Risks and Mitigation

Every investment carries risks, and blockchain is no exception.

How Certuity Can Help

Certuity offers comprehensive family office services to guide investors through the complexities of blockchain technology. From tax-efficient strategies to portfolio diversification, Certuity provides tailored solutions to help you achieve your financial goals.

Contact Certuity:

- Website: Certuity Family Office Services

- Address: Manhattan Beach, CA, and Miami, FL.

- Phone: (305) 123-4567

With Certuity’s expertise, you can confidently explore blockchain investments while mitigating risks.

Conclusion

Blockchain technology represents a transformative investment opportunity in 2025. Whether through cryptocurrencies, blockchain stocks, or startups, the potential for growth is immense. Staying informed, diversifying your investments, and partnering with trusted advisors like Certuity will ensure your success in this rapidly evolving space.

As Bill Gates aptly said, “The future of money is digital currency.” Embrace the future by investing in blockchain technology today.