The post Best Trading Sites in the Philippines: Overview appeared first on Block-Poc Chain.

]]>The world of online trading has grown significantly in the Philippines, with more investors looking for reliable platforms to manage their financial assets. Whether you are trading stocks, cryptocurrencies, forex, or commodities, selecting the right trading site Philippines is crucial for success. The country’s financial sector is expanding, and regulatory bodies like the Securities and Exchange Commission (SEC) and the Bangko Sentral ng Pilipinas (BSP) have implemented rules to ensure the safety of investors.

One of the fundamental metrics used by investors to evaluate a company’s financial health is the roe formula (Return on Equity). It helps traders determine how effectively a company is utilizing its capital to generate profits. When selecting a trading site Philippines, it is essential to have access to financial analysis tools that allow you to assess key metrics, including the roe formula. These features can significantly enhance decision-making, making online trading a more rewarding experience.

Key Features to Look for in a Trading Site

When choosing the best trading site Philippines, there are several factors to consider. The right platform should offer a user-friendly interface, robust security measures, and various asset classes. Below are some of the most important features that traders should prioritize:

Regulatory Compliance

A legitimate trading site must be regulated by the appropriate financial authorities. In the Philippines, the SEC oversees stock and securities trading, while the BSP regulates financial service providers, including some forex and cryptocurrency platforms. Ensuring that a trading site is compliant with these regulators is essential for safeguarding investments.

Trading Fees and Costs

Different platforms have varying fee structures, including commission fees, spreads, and withdrawal charges. Low-cost trading platforms are ideal for frequent traders, while long-term investors might focus more on features like research tools and customer service.

Asset Variety

A diversified portfolio is crucial for risk management. Top trading sites offer a wide range of assets, including stocks, forex, cryptocurrencies, ETFs, and commodities. The ability to trade multiple asset classes within a single platform provides flexibility and better investment opportunities.

Research and Educational Tools

A good trading platform should provide educational resources and market research tools. Beginners benefit from tutorials, webinars, and demo accounts, while advanced traders require analytical tools, charting software, and access to fundamental data like the roe formula.

Customer Support

Reliable customer support is vital when trading online. A good platform should offer multiple support channels, including live chat, email, and phone support, with prompt response times.

Conclusion: Choosing the Best Trading Site

Selecting the best trading site Philippines depends on individual trading needs, experience level, and investment goals. Whether you are looking for a stock trading platform like COL Financial, a social trading platform like eToro, or a cryptocurrency exchange like Binance, the key is to find a platform that aligns with your financial strategy. Additionally, using financial metrics like the roe formula can help in making informed investment decisions. By prioritizing regulatory compliance, trading costs, asset variety, research tools, and customer support, traders can enhance their overall trading experience and achieve financial success in the Philippine market.

The post Best Trading Sites in the Philippines: Overview appeared first on Block-Poc Chain.

]]>The post Blockchain vs. Traditional Assets: Top 5 Differences and Opportunities appeared first on Block-Poc Chain.

]]>In this article, we explore the top five differences and opportunities between blockchain and traditional assets, helping you make informed investment decisions. We’ll also highlight how Certuity’s wealth management services can assist in diversifying and optimizing your portfolio.

| Aspect | Blockchain Assets | Traditional Assets |

|---|---|---|

| Ownership | Decentralized and verified via smart contracts. | Centralized, often requiring intermediaries. |

| Liquidity | Highly liquid due to 24/7 trading platforms. | Limited by market hours and regulatory rules. |

| Transparency | Transactions recorded on public ledgers. | Dependent on audited financial statements. |

| Accessibility | Open to global investors via digital platforms. | Often limited by geographic or regulatory barriers. |

| Volatility | High volatility due to market immaturity. | Relatively stable, influenced by macroeconomic factors. |

Opportunities in Blockchain Assets

Blockchain assets, such as cryptocurrencies, tokenized real estate, and decentralized finance (DeFi) products, present unique opportunities for investors:

1. Global Accessibility

Blockchain enables fractional ownership, allowing investors worldwide to participate in high-value assets like real estate or art through tokenization.

2. Transparency

All transactions are recorded on an immutable ledger, ensuring greater transparency and reducing fraud risks.

3. Innovation Potential

Blockchain powers innovations such as non-fungible tokens (NFTs), digital identity solutions, and decentralized autonomous organizations (DAOs).

Opportunities in Traditional Assets

Traditional assets offer advantages that blockchain-based investments cannot yet match:

1. Stability

Traditional assets, particularly bonds and blue-chip stocks, provide a stable and predictable return over time.

2. Regulatory Protections

Government bodies often insure or regulate Investments in traditional markets, offering investors peace of mind.

3. Income Generation

Dividend-paying stocks and rental income from real estate provide steady cash flows for long-term investors.

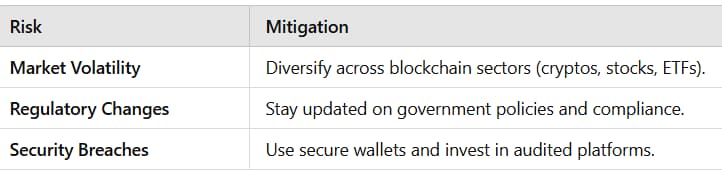

| Factor | Blockchain | Traditional Assets | Which to Choose? |

|---|---|---|---|

| Risk Appetite | High-risk, high-reward. | Moderate to low risk. | Choose based on your risk tolerance. |

| Time Horizon | Short-term gains in fast-moving markets. | Long-term stability. | Balance both for diversification. |

| Diversification | New asset classes like NFTs and DeFi. | Broad options: stocks, bonds, real estate. | Combine to maximize opportunities. |

| Technological Savvy | Requires understanding of blockchain tech. | Familiar frameworks. | Education is key to embracing blockchain. |

Quotes on Blockchain and Traditional Assets

- Bill Gates: “Blockchain – blockchain.com, is a technological tour de force.” Gates highlights the transformative potential of blockchain assets in reshaping industries.

- Warren Buffett: “Never invest in a business you cannot understand.” This advice underscores the importance of educating yourself about both blockchain and traditional markets before investing.

How Certuity Can Help

Navigating the evolving investment landscape requires expertise and strategic planning. Certuity offers comprehensive wealth management services tailored to your financial goals, whether you’re interested in blockchain opportunities, traditional assets, or a hybrid portfolio.

Certuity Contact Information:

- Website: https://certuity.com/new-york/

- Address: Manhattan Beach, CA, and New York, NY.

- Phone: (212) 555-6789

Certuity’s experienced advisors can help you assess risk, optimize asset allocation, and ensure compliance with evolving regulations.

Conclusion

The choice between blockchain and traditional assets doesn’t have to be an either-or decision. Each offers unique advantages and risks; the best strategy often involves a balanced approach. Blockchain assets provide innovation and transparency, while traditional assets offer stability and regulatory protection.

By partnering with trusted wealth management services like Certuity, you can confidently navigate this dynamic investment landscape, ensuring your portfolio is well-positioned for future growth.

Invest wisely, and remember the words of Jeff Bezos: “In the end, we are our choices.” Choose a strategy that aligns with your financial goals and risk tolerance to unlock your full investment potential.

The post Blockchain vs. Traditional Assets: Top 5 Differences and Opportunities appeared first on Block-Poc Chain.

]]>The post How to Invest in Blockchain Technology in 2025 appeared first on Block-Poc Chain.

]]>This guide will explore how to invest in blockchain technology strategically, offer insights into emerging trends, and explain how Certuity’s family office services can help you make informed decisions to maximize your returns.

Why Invest in Blockchain Technology?

Blockchain is more than just a buzzword; it’s a transformative force.

- Global Market Growth: The global blockchain market is projected to grow from $11.1 billion in 2022 to over $162 billion by 2027 (CAGR of 67.6%).

- Diverse Applications: From smart contracts and decentralized finance (DeFi) to non-fungible tokens (NFTs) and supply chain transparency, blockchain’s use cases are expanding rapidly.

- Institutional Adoption: Companies like Microsoft, IBM, and JPMorgan Chase are leveraging blockchain for security, efficiency, and transparency, signaling long-term value.

- Financial Inclusion: Blockchain simplifies access to financial services for unbanked populations, creating new markets and economic opportunities.

Ways to Invest in Blockchain Technology

1. Cryptocurrency Investments

Cryptocurrencies remain the most accessible blockchain-related investment. Popular options include:

- Bitcoin (BTC): The pioneer cryptocurrency, often referred to as “digital gold.”

- Ethereum (ETH): Supports smart contracts and decentralized applications (DApps).

Altcoins: Specialized tokens like Solana, Cardano, and Polkadot.

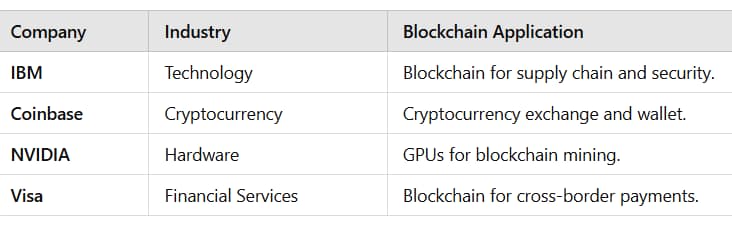

2. Blockchain Stocks

Investing in companies that develop or utilize blockchain technology offers a more traditional route.

3. Blockchain ETFs

Exchange-Traded Funds (ETFs) offer diversified exposure to blockchain without the need for direct investment in individual stocks or cryptocurrencies.

4. Startups and Venture Capital

Investing in blockchain startups can yield high returns if you identify emerging leaders. Key areas to watch include:

- DeFi platforms.

- NFT marketplaces.

- Blockchain for healthcare and identity verification.

5. Real Estate on Blockchain

The tokenization of real estate allows fractional ownership of properties, enabling investors to enter markets with smaller capital.

Blockchain Trends for 2025

- Decentralized Finance (DeFi): DeFi is transforming traditional banking by offering decentralized lending, borrowing, and trading.

- Central Bank Digital Currencies (CBDCs): Governments worldwide are launching digital currencies, legitimizing blockchain on a global scale.

- NFT Evolution: NFTs are evolving beyond digital art into real-world applications like ticketing, gaming, and intellectual property.

- Green Blockchain: Eco-friendly blockchain networks like Cardano and Algorand will gain prominence as sustainability becomes a focus.

- Interoperability: Platforms enabling seamless communication between blockchains will drive innovation.

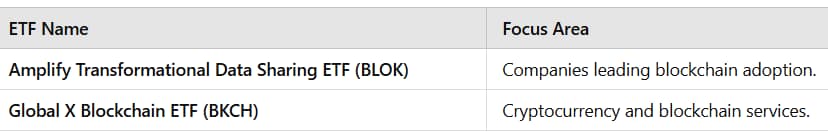

Risks and Mitigation

Every investment carries risks, and blockchain is no exception.

How Certuity Can Help

Certuity offers comprehensive family office services to guide investors through the complexities of blockchain technology. From tax-efficient strategies to portfolio diversification, Certuity provides tailored solutions to help you achieve your financial goals.

Contact Certuity:

- Website: Certuity Family Office Services

- Address: Manhattan Beach, CA, and Miami, FL.

- Phone: (305) 123-4567

With Certuity’s expertise, you can confidently explore blockchain investments while mitigating risks.

Conclusion

Blockchain technology represents a transformative investment opportunity in 2025. Whether through cryptocurrencies, blockchain stocks, or startups, the potential for growth is immense. Staying informed, diversifying your investments, and partnering with trusted advisors like Certuity will ensure your success in this rapidly evolving space.

As Bill Gates aptly said, “The future of money is digital currency.” Embrace the future by investing in blockchain technology today.

The post How to Invest in Blockchain Technology in 2025 appeared first on Block-Poc Chain.

]]>The post Blockchain in healthcare and government appeared first on Block-Poc Chain.

]]>Challenges of today’s healthcare system

Counterfeit medicines

The healthcare supply chain has one of the biggest challenges. Counterfeit drugs cause a lot of damage not only to people but also to the healthcare industry. Without proper control, many medicines are counterfeited every year.

About 10% -30% of medicines are counterfeit and many people get sick every day. Right now, the market for counterfeit drugs is over $200 billion dollars a year. This means that about 1/3 of the medicines supplied are counterfeit.

Data Segmentation

Another problem in this industry is the problem of data segmentation. Usually a lot of important information such as patient data is scattered all over the network. And so when it is needed, no one can find the right information at the right time.

So when doctors need to know the patient’s medical history, they cannot get all the information at once. Thus, doctors cannot provide the patient with the treatment they need.

Poor management

The management system of the healthcare industry is not up to the mark. They cannot offer an efficient system where everything is streamlined.

Health care and data storage

Often someone misuses valuable information about medical data. Moreover, selling this information to outside companies jeopardizes patient privacy. Also, many people are misled by flawed clinical trial reports.

How blockchain can help

- Enable interoperability between systems

- Provide a higher level of security

- Provide lower cost of care

- Ensure data integrity

- Offer universal access

Blockchain applications for healthcare

Clinical trials

Blockchain can improve clinical trial monitoring by eliminating fraud and data manipulation. Using the platform, they can store all information in a ledger and further simplify the output. It will also greatly improve healthcare itself.

Claims and billing

The billing process is quite complex and takes up a lot of precious time. By removing intermediaries, blockchain can improve both claims and billing in healthcare. Sometimes, bad intermediaries tend to bill more than they are phakeically. Thus, blockchain for enterprise will get rid of such bad players.

Drug Tracking

As you already know, counterfeiting of medicines is a huge problem. But blockchain for enterprise can offer timestamps for medicines and transactions to solve it. It can solve the problem of recognizing counterfeiting by providing time-fixed immutable transactions across the supply chain.

Patient data management

Blockchain can be used to store data securely. It improves personalization and pinpointing of patient data.

Blockchain for public services

Law enforcement

If governments use public blockchain, they can fight money laundering. A public blockchain will monitor the process of legal transactions and work whenever they see a bad player.

Taxation

The taxation process is overly complicated every year and many people don’t even pay taxes even though they should. Thus, governments lose valuable tax money every year.

Legislation. Reports

Legislative records are one of the most important elements of government. If they can make them fully digitized, they can keep better records of them. Moreover, blockchain for enterprise networks can really help here.

Welfare distribution

The government’s welfare projects suffer from systemic loss and mismanagement. Adopting enterprise blockchain in this can significantly reduce system losses and offer better governance on welfare issues.

Healthcare services

As you already know, the healthcare industry can shine with blockchain, and governments can be the ones to adopt this technology in the industry.

Digitized Identities

What’s the best way to have blockchain for corporate networks within governments to preserve public rights of way? If governments can offer digital identities, the problems with identity theft will decrease dramatically.

Cyber security

Government infrastructures have a very old network system that makes it susceptible to hacking. But they can use enterprise blockchain to combat cyberattacks.

The post Blockchain in healthcare and government appeared first on Block-Poc Chain.

]]>The post Main barriers to implementation appeared first on Block-Poc Chain.

]]>They say that it is impossible to make it faster, better and cheaper, but you will not go far in the implementation of blockchain in the enterprise if will be satisfied with only two of these qualities.

So what are the main obstacles to implementing blockchain technology. When choosing an appropriate solution, you need to answer at least the following questions.

– Does the “solution” meet the standards of the industry’s reference architecture? Without this, it will not be able to integrate into industry systems for public and private blockchain transaction processing. It’s unfortunate, but you can’t do without profit-hungry middlemen just yet. All of the infrastructure, processes and systems that make the world go round (and do a pretty good job of it), if they are to be scrapped and replaced by something coherent, it won’t happen tomorrow.

– Does the “solution” fit into the reference architecture of the OSI model? Since blockchain is sometimes referred to as Web 3.0, the Internet of Value, or any other sales and marketing jargon, the solution should fit the most current industry standard that most closely resembles the OSI articulated standards for networks, the Internet, and web services. Yes, technology, like standards, must evolve to meet new usage scenarios for mass consumption.

– How is it easier to fit your blockchain “solution” into the Enterprise Technology Framework? This enterprise technology framework defines the technology services and functions (IT capabilities) required to support business applications and data. These include common (or shared) application services, common system and data services, network services, security services, platform services and administration tools that enable IT service delivery. It may also be helpful to identify the specifics of the business or new business service that may be required. Or, in the case of a hybrid cloud model, which system or service should be based in the enterprise data center (e.g., System of Record) and which can be offered in a public cloud SaaS model or made available through a System of Engagement via a smartphone or other mobile device. Enterprise Technology Framework environments provide a blueprint for solving business problems including applications, services, systems and data. And blockchain can relate to some of the above.

In addition, when thinking about finding a problem that your blockchain “solution” should solve, you need to think about the architectural principles underlying it. Failure to think holistically about this issue is fraught with challenges (in technology and business, individual and enterprise level) that blockchain will not be able to solve. Note that these are not architectural “givens,” they are architectural drivers or principles that require some sort of overcoming to truly embrace and utilize.

The post Main barriers to implementation appeared first on Block-Poc Chain.

]]>The post Why you need blockchain in your company appeared first on Block-Poc Chain.

]]>Let us present a case where this property may be in demand. There is a large metallurgical plant and an oil and gas company. The company orders pipes from the plant, the plant produces them. The quality of the pipes is checked, recorded in some system. Then the pipes are transported by rail, the transportation operator marks them in his system. After transportation the pipes are checked again and the result is recorded somewhere. The pipes arrive at the warehouse and their status is again recorded somewhere. As a result, many intermediate systems like SAP or 1C interact in one process, and it is reasonable to automate this interaction.

The first option is standard point-to-point integrations with all counterparties. With one plant and one oil and gas company, everything is simple: there is only one integration. A transportation company is added – we get three integrations. And then the number of integrations increases exponentially, according to the formula n*(n-1)/2), where n is the number of participants. The task is complicated by the fact that all systems available on the market do not provide for data harmonization. Large companies have been doing such projects for many years, spending many millions and bloating the IT staff to ridiculous sizes. But if the business develops, sooner or later the peer-to-peer approach will complicate the work so much that employees will start solving all problems the old-fashioned way, through mail, phone or whatever.

The second option is a single database in some cloud. The plant, oil and gas company and other contractors would be happy to add all pipes there and just change their statuses. The data reconciliation problem is solved, but many others arise. Who will be responsible for the data? What about “trade secret information”? Can the cloud provider be trusted? Everyone involved is willing to be responsible for their data, but few will trust anyone else with it – and the bigger the company, the more closed.

The third option – a developer of an industry solution comes to the market claiming to be able to solve all business process problems. You just need to exchange data with him. Most of the integrations with an unlimited number of participants are done in this way, with the help of service providers. But who will act as a service provider? Let’s take the example of sensitive data – for example, the exchange of credit histories. Sberbank could act as a service provider here, but such a position would give it an uncompetitive advantage. In this case, the issue is solved with the help of an independent participant with special powers – BCI, a credit history bureau. The BCI is engaged in data exchange and develops the necessary software for this purpose.

Let us assess the possible problems of this approach. The creation of a new global market player will require large expenses, and in cases like the one described above, it will also require changes in legislation. All data is centralized in one place and therefore the whole system becomes more vulnerable. The service provider itself may leak the data for its own benefit or by mistake.

Finally, we come to a solution via blockchain. The main advantages here are:

- You can share data, but still retain control over who sees what data.

- The number of integrations required will always be equal to the number of participants.

- Each participant is only responsible for its own infrastructure.

- The loss of any node in the network will not affect its resilience.

- There are, of course, disadvantages, mostly organizational.

- Each company will have to work on creating the necessary infrastructure at its own place. This can be characterized as self-service SaaS.

All interested companies need to organize themselves and agree on how they will build the blockchain. Few people work in such a masternet.

The post Why you need blockchain in your company appeared first on Block-Poc Chain.

]]>